How much does that glass of wine cost?

Posted by: Gary Ernest Davis on: October 27, 2010

No: the answer depends on how old you are when you drink it, and what you would do with the money otherwise.

I was watching a recent Suze Orman show and I admired the way she drove home the real cost of spending by relating it to a single everyday item.

Here’s my take on her message.

Suppose a young person spends 0 each month on entertainment which amounts mainly to drinking in clubs and bars. This was, in fact, the figure quoted by the young man on the Suze Orman program.![]()

Over a working lifetime from 21 to 67 years of age this amounts to over a – staggering – $220,000 on alcohol.

But the financial cost is actually much greater.

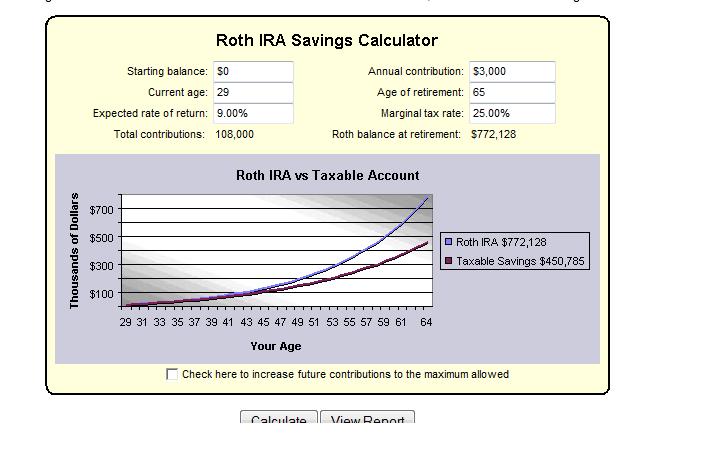

Suppose the $400 each month is invested instead in a Roth IRA with an annual return of 8% per annum.

At age 67, after years of investing $400 each month from the age of 21, the accumulated savings amount to $2,290,000: tax free.

These are today’s dollars, so we have to think about inflation. Currently that’s low, but it might, and probably will, rise in the future. By the same token the return on the Roth IRA will also likely rise as inflation rises.

These are today’s dollars, so we have to think about inflation. Currently that’s low, but it might, and probably will, rise in the future. By the same token the return on the Roth IRA will also likely rise as inflation rises.

So let’s say a 21 year old does not put $400 each month into a Roth IRA but spends that $400 on alcohol until, at the age of 30, they decide to change their ways and start saving for their retirement.

Now the $400 each month in the Roth IRA is being invested for 9 less years. Not so bad, you think: this person is still young.

The accumulated savings from 30 to 67 yeas of age is now $1,087,000: again, tax free.

By drinking for 9 years the young person has lost over 1,200,000 tax free dollars.

The drinks in those 9 years cost $43,200.

So a drink that, on the face of it, costs $10 with tip in that person’s 20s, in fact cost them over $278 in lost savings.

The $10 drink effectively costs $278.

That’s the price you are really paying when you are young.

Just one more reason, by the way, that G.V. Ramanathan is wrong: quantitative literacy is important for everyone.

October 27, 2010 at 4:24 pm

Ah, but where are you going to find anything these days that returns 8% per year instead of 0.08%? Or even -0.08%?

October 28, 2010 at 6:20 am

Currently Roth IRAs are returning > 8%